Influencer Highlight: Josh DeTar

From Overdrafts to Impact: How Josh DeTar is Transforming Credit Unions and Children’s Lives

When Josh DeTar speaks about credit unions, it’s with a fervor that’s deeply personal. Today, he’s the Executive Vice President of Evangelism at Tyfone, a leading digital banking and payments company. But long before he became a respected voice in the credit union industry, Josh was a teenager navigating life on his own — and struggling to understand basic financial tools like debit cards, overdrafts, and credit.

At 17, Josh moved out of his home and, like many young adults, quickly found himself overwhelmed by financial decisions he wasn’t prepared to make. One overdraft too many landed him in a branch of the big bank he was currently working with, where a frustrated teller told him to take his business elsewhere. But fate had other plans.

While working at a manufacturing facility, a colleague suggested he visit the company’s SEG-based credit union. There, a branch manager saw potential in Josh. She helped him open his first proper account, taught him the basics of credit, and even guided him through small credit-building steps — like purchasing new tires on a credit card. That personal care left a lasting impression.

“I’ve been a member of that credit union ever since,” Josh says.

Though his career began in mechanical engineering — a nod to his love for building — Josh soon realized he was more passionate about building relationships than machines. That realization ultimately led him to Tyfone, where he merged his enthusiasm for technology with his deep commitment to the credit union movement. After connecting with Tyfone’s CEO, Siva Narendra, Josh joined the company and has now been with the team for nearly a decade, playing a critical role in its sales and marketing strategy.

But Josh’s story doesn’t end at career success. The same credit union that helped him as a young man later invited him to serve on its board as well as it’s supervisory committee, as committee chair — a full-circle moment that speaks volumes about his journey and his passion.

This passion extends beyond technology. It spills into his philanthropic work with Credit Unions for Kids, a program of Children’s Miracle Network Hospitals that unites credit unions to raise funds for pediatric care. Josh had long admired the CU4Kids movement, often participating in industry initiatives like #ShadesUpForKids on LinkedIn. But he wanted to create something more personal — something that reflected both his lifestyle and Tyfone’s company culture.

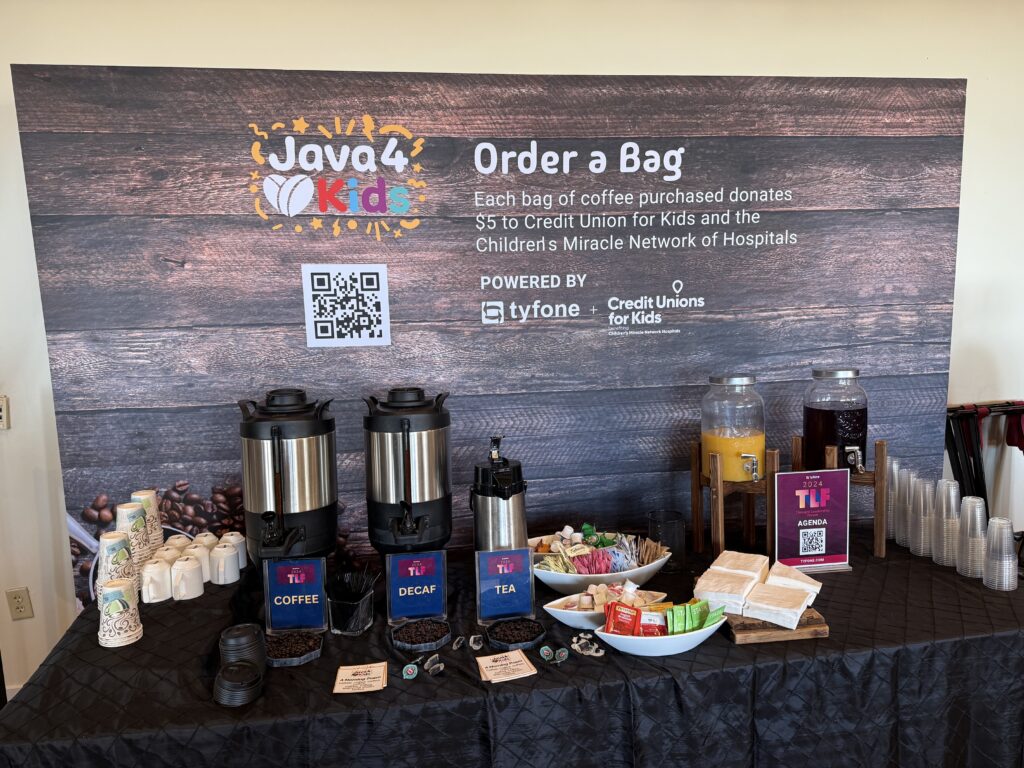

Enter Java4Kids.

The idea came during a weekend coffee chat with his brother-in-law, who mentioned gifting coffee to his home-buying clients. A light bulb went off. “We drink a lot of coffee at Tyfone,” Josh laughed. By Monday morning, the Java4Kids website was live.

Java4Kids blends Josh’s love of coffee with his passion for children’s health. The initiative gives Tyfone employees a tangible, feel-good way to give back — and it’s taken off. What started as a grassroots idea has grown into a company-wide movement. More and more Tyfone employees are joining the effort, proud to support a cause that impacts real families in their communities.

Josh’s personal connection to CU4Kids deepened even further when his infant daughter was hospitalized with RSV at just six days old. As he walked through the hospital doors, he saw the familiar Children’s Miracle Network balloon — and suddenly, it all came full circle. “It hit home in a way I never expected,” he recalls.

He’s adamant that credit unions must be involved in CU4Kids if they’re serious about their mission. “If you’re a credit union and not involved with CU4Kids, you’re not living up to your mission of being a credit union,” Josh says. He credits fellow advocate Seth Schafer for reinforcing the message: if credit unions are committed to financial health, they must also care about physical health — the two are intrinsically linked.

“You need to find something that’s right for you,” Josh emphasizes. “For us, Java4Kids perfectly slots into our culture. It aligns so perfectly with the organization’s objectives.”

From once being told to take his business elsewhere, to now shaping the future of digital banking and championing children’s health, Josh DeTar is a powerful example of how compassion, community, and technology can intersect to create meaningful change.